Trusted by

Trusted by

Video description

A personalized feed full of bite-sized financial education and snackable articles, all curated to be inclusive of circumstances and interests. In one click, save and review later - or share with friends and family so they can benefit too. With a 68% global engagement rate, nudge makes the world of money fun, familiar and accessible.

Step inside our library of dynamic financial education stories, designed to help you achieve what you want in life - from everyday money management to more complex finance topics. Interactive, impartial financial education, money management tools and progress trackers mean you’ll never miss a step.

Powered by behavioral psychology and data. When there’s something you need to know, or a financial action you ought to take, we’ll send you a personalized, timely nudge as a reminder. Then step by step, before you know it, you’re on a path to prosperity. Send a nudge via SMS, email, Slack, Teams, WhatsApp or Meta. And guess what? Only 1% of people unsubscribe.

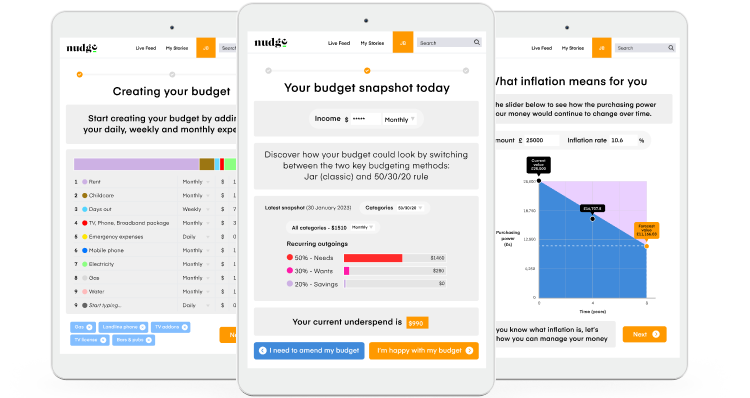

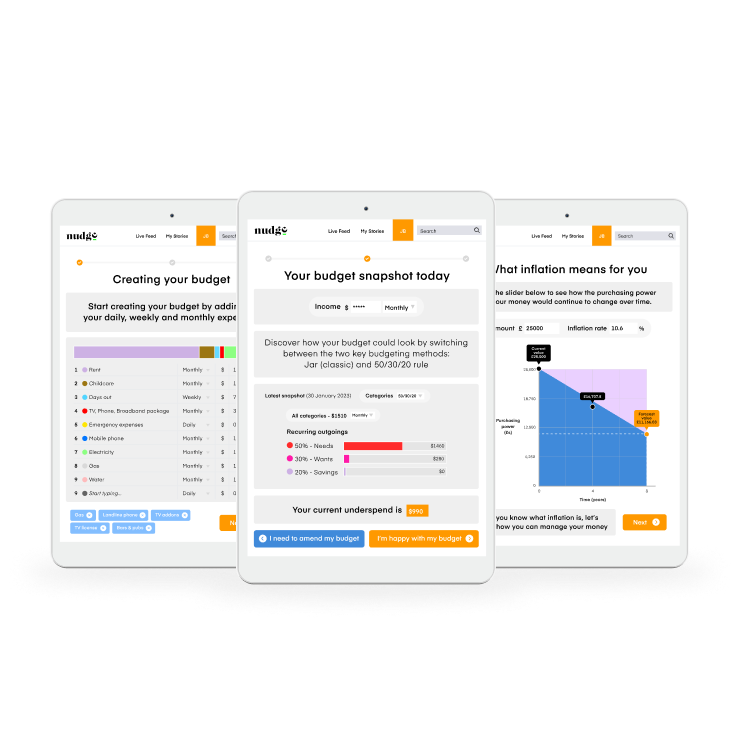

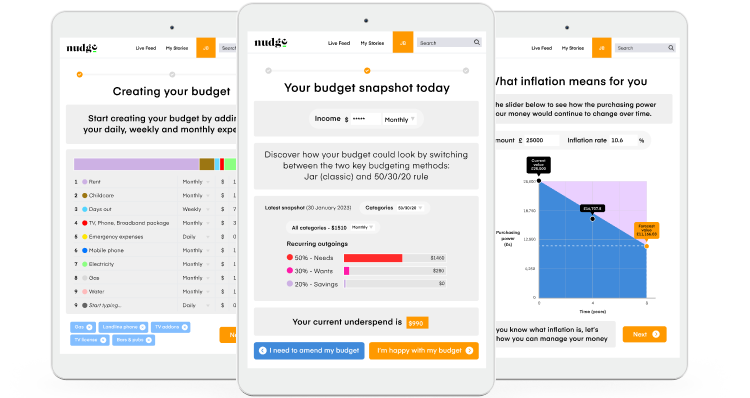

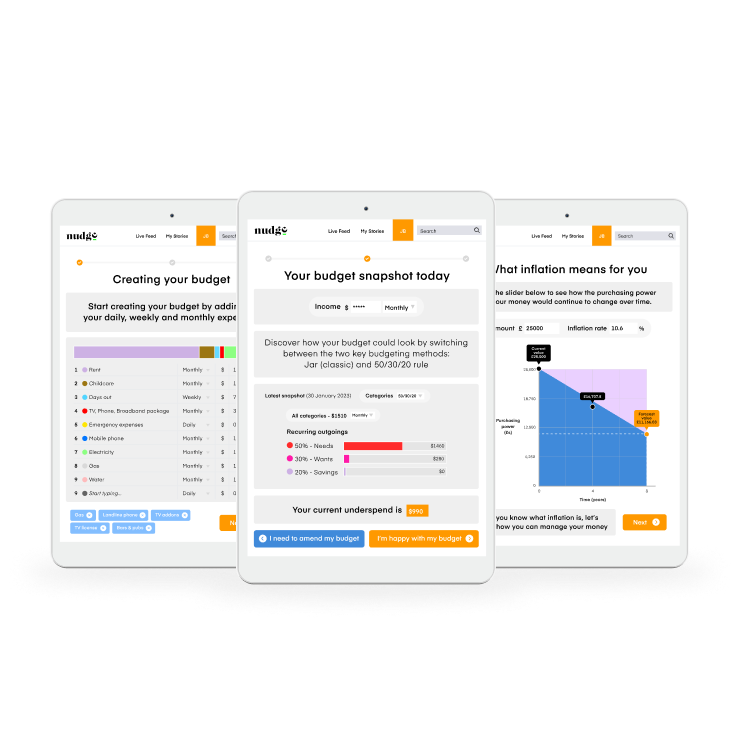

Our interactive tools help you plan, prepare and organize your finances from the unexpected to the expected. The tools (for budgeting, saving and investing) are embedded in stories, simplifying money at exactly the right time in your learning journey.

Our financial health checkup helps you understand where you’re thriving and where there’s room for improvement. From saving and spending to borrowing and planning, you’ll get an instant score and financial education plan to improve your financial health. A financial health score enables you to measure your progress over time, and take action.

Book a demo

have reduced their debt

have increased their savings

are more hopeful about their financial situation

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

CTA

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum. 2

CTA 2

Take a tour of nudge’s key features and find out how we empower 1.5m+ users with personalized, impartial financial education for brighter financial futures.

When it comes to financial education for all, we provide everyone with a consistent, personalized experience. nudge provides country specific financial education in local language and currency, including these key features:

Praesent nonummy mi in odio. Donec interdum, metus et hendrerit aliquet, dolor diam sagittis ligula, eget egestas libero turpis vel mi. Fusce convallis metus id felis luctus adipiscing. Sed magna purus, fermentum eu, tincidunt eu, varius ut, felis.

nudge’s impartial financial education is created and maintained by our financial experts and delivered through market-leading technology.

Our editorial team research, compose, design and deliver in-country financial education. And as the nudge community grows, so does our global editorial team, supporting our client's key locations, in their local languages.

Something for everyone

Topics and mixed media content

Data driven personalization

Right content, to the right person, at right time

WCAG compliant

Highest accessibility standard

Community support

Targeted campaigns and masterclasses for employee resource groups

Global tech experience

Equitable support for all your locations

Learn how Expedia rolled out nudge in 57 countries.

View case study300+

Global clients

100+

Countries

1.5m

Lives touched

A personalized feed full of bite-sized financial education and snackable articles, all curated to be inclusive of circumstances and interests. In one click, save and review later - or share with friends and family so they can benefit too. With a 68% global engagement rate, nudge makes the world of money fun, familiar and accessible.

Powered by behavioral psychology and data. When there’s something you need to know, or a financial action you ought to take, we’ll send you a personalized, timely nudge as a reminder. Then step by step, before you know it, you’re on a path to prosperity. Send a nudge via SMS, email, Slack, Teams, WhatsApp or Meta. And guess what? Only 1% of people unsubscribe.

Step inside our library of dynamic financial education stories, designed to help you achieve what you want in life - from everyday money management to more complex finance topics. Interactive, impartial financial education, money management tools and progress trackers mean you’ll never miss a step.

Our interactive tools help you plan, prepare and organize your finances from the unexpected to the expected. The tools (for budgeting, saving and investing) are embedded in stories, simplifying money at exactly the right time in your learning journey.

Our financial health checkup helps you understand where you’re thriving and where there’s room for improvement. From saving and spending to borrowing and planning, you’ll get an instant score and financial education plan to improve your financial health. A financial health score enables you to measure your progress over time, and take action.

Book a demoGet started for free today. Book a demo.

Here are a few of our frequently asked questions. Looking for more? Check out the full list below. Or get in touch and we can talk.

READ FULL FAQSnudge is an impartial, global financial education platform for all.

Our platform coaches you to take action on your finances, to feel in control of life. Key features include:

No. nudge is 100% impartial financial education.

That's transparent and free from product or provider bias. This allows nudge to focus on improving financial skills and knowledge without the conflict of product or service distribution.

Yes. nudge technology uses data and behavioral psychology to deliver the right content to the right people, at the right time - be that our content or your own.

You can access a variety of money management tools, designed to help you budget, invest and save.

Fusce risus nisl, viverra et, tempor et, pretium in, sapien. Phasellus consectetuer vestibulum elit. Proin viverra, ligula sit amet ultrices semper, ligula arcu tristique sapien, a accumsan nisi mauris ac eros. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus.

Fusce risus nisl, viverra et, tempor et, pretium in, sapien. Phasellus consectetuer vestibulum elit.

Fusce risus nisl, viverra et, tempor et, pretium in, sapien. Phasellus consectetuer vestibulum elit. Proin viverra, ligula sit amet ultrices semper, ligula arcu tristique sapien, a accumsan nisi mauris ac eros. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus.

Discover the true needs of your employees to inform your wellbeing strategy, drive uptake of employee benefits and boost your people’s financial wellbeing.

Gain a better understanding of your customers to inform your engagement strategy, educate customers on your products and support their wellbeing.

In hac habitasse platea dictumst. Donec posuere vulputate arcu. Etiam vitae tortor. Sed cursus turpis vitae tortor.

Learn morePellentesque libero tortor, tincidunt et, tincidunt eget, semper nec, quam.

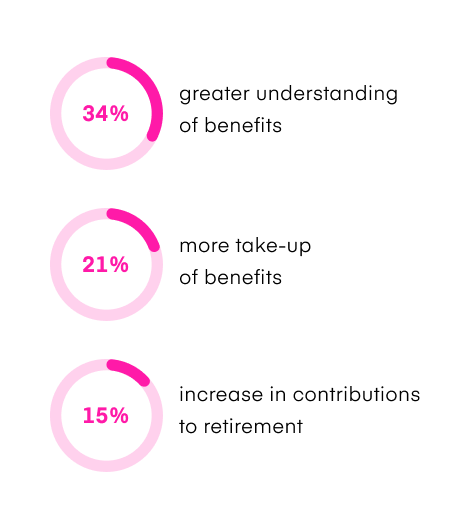

76% of employees say that they’ve had challenges understanding and making the most of their benefits.

The opportunity to increase benefit understanding and utilization is huge and the potential to improve financial wellbeing is even bigger. Find out how to educate and drive action on your benefits to improve your people's financial wellbeing today.

Get started for free today. Book a demo.