At the core of your global financial wellbeing program, nudge’s impartial financial education platform empowers your people to take control of their money. Combining behavioral psychology, data, and personalized education – nudge coaches your people to develop their financial skills and knowledge, wherever and whenever they need it.

have reduced their debt

have increased their savings

are more hopeful about their financial situation

We offer a consistent, personalized technology experience with locally relevant education wherever you are in the world.

Our global team of personal finance experts research, curate, design and publish all our in-country financial and benefit education. And as the nudge community grows, so does our team of experts, supporting our clients’ key locations, in their local languages.

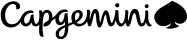

Using profile data, geographical location, personal circumstances, market events, and employee added interests, an individual consumes education through an intuitive education feed. Curated by our in-house personal finance experts includes the latest, most relevant financial education. This personalization, along with multi-formats (long-form, short-form, video, audio, infographics, interactive tools), makes nudge a simple, natural, and engaging experience.

Powered by behavioral psychology and data. When there’s something you need to know, or a financial action you ought to take, we’ll send you a personalized, timely nudge as a reminder. Then step by step, before you know it, you’re on a path to prosperity. Choose to receive nudges via email, SMS, WhatsApp or MS Teams. And guess what? Only 1% of people unsubscribe.

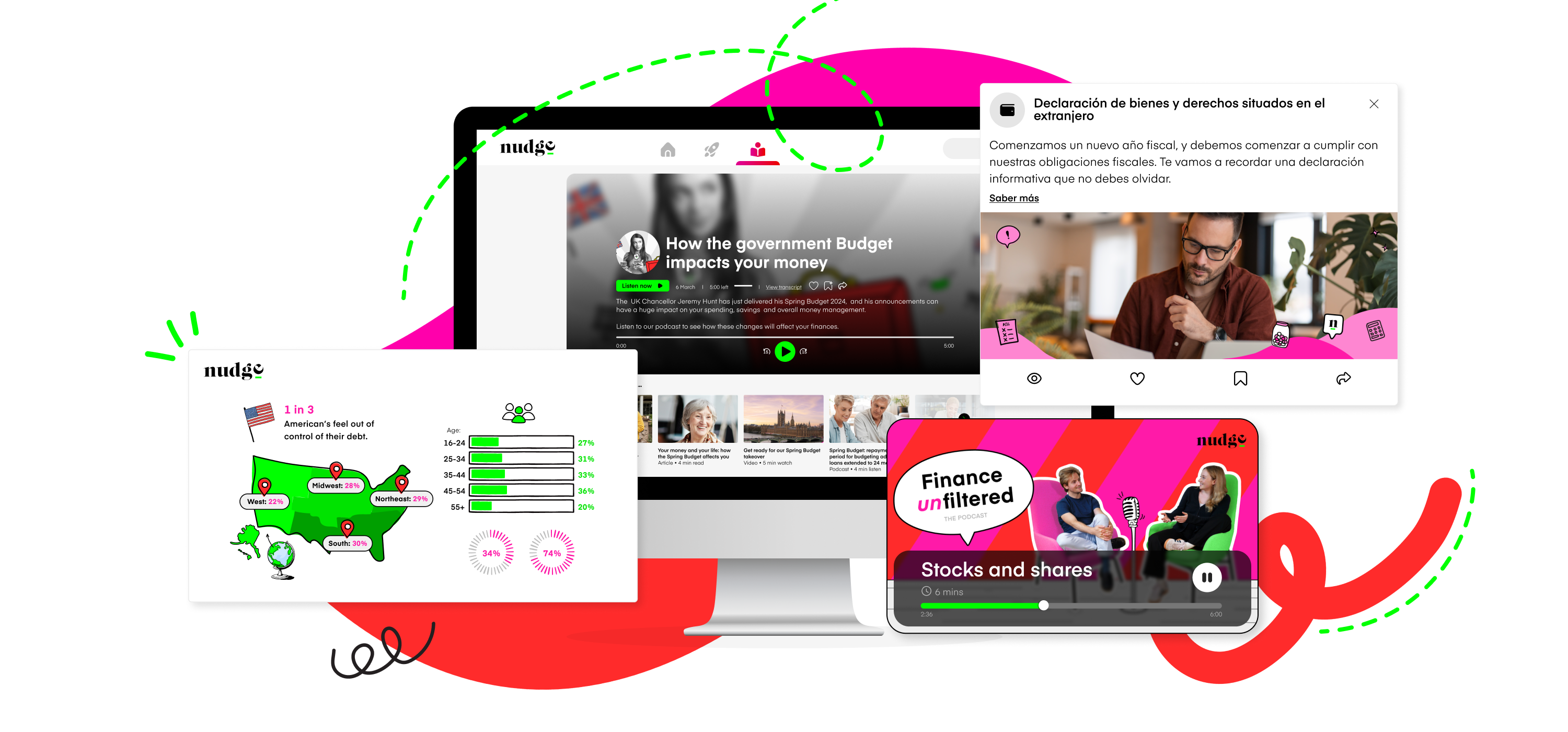

Powered by AI, your people can ask their money coach a question and receive impartial, validated, and up-to-date information on their finances and benefits. This creates a safe space to understand the world of money and build skills.

Whether your people are worrying in the middle of the night, or planning future goals with their family, nudge’s money coach is always there to support them.

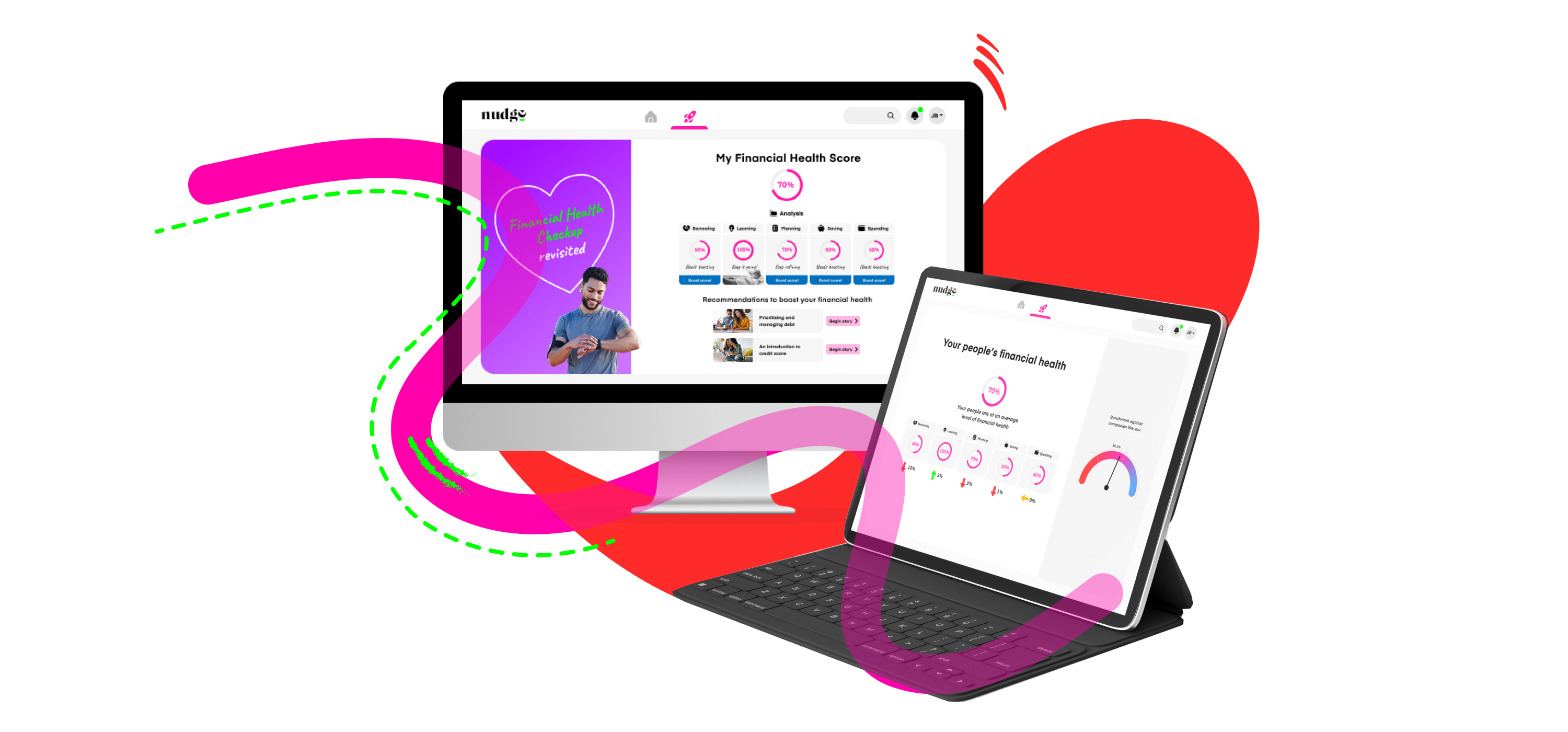

Our financial health checkup helps you understand where you’re thriving and where there’s room for improvement. From saving and spending to borrowing and planning, you’ll get an instant score and financial education plan to improve your financial health. A financial health score enables you to measure your progress over time, and take action.

These 20-minute engaging sessions cover a range of topics like investing, debt and budgeting and are accessible through the platform 24/7 – so people can learn in their own time and with their loved ones. During the sessions people are signposted to take action on their finances, work through activities and continue their learning on nudge.

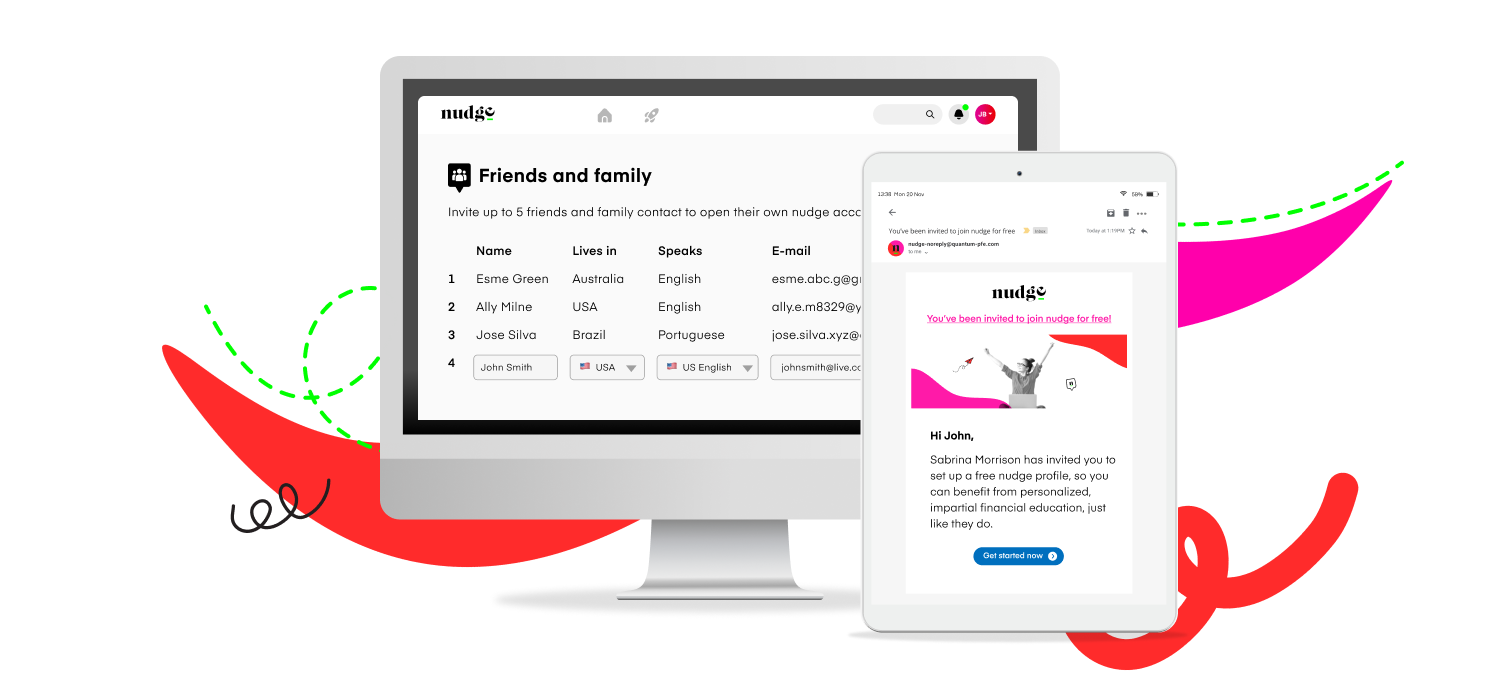

Friends and family premium gives your people the opportunity to invite five people to set up their own personal nudge account – so they can also benefit from personalized financial education. Even better, those loved ones can be anywhere in the world and can receive nudge in the language that works for them, with education that is locally relevant.

Whether it’s voluntary resignation or a business restructure, it’s important to protect your brand as a caring, responsible employer once an employee has left. Alumni experience enables you to provide nudge for an extra six months after a person leaves, so they can continue to benefit during change in circumstances.

Book a demoTake a tour of nudge’s key features and find out how we empower 2m+ users with personalized, impartial financial education for brighter financial futures.

Here are a few of our frequently asked questions. Looking for more? Check out the full list below. Or get in touch and we can talk.

READ FULL FAQSnudge is an impartial, global financial education platform for all. Combining behavioural psychology, data and personalized education, nudge empowers people to develop their financial skills and knowledge. A global solution without conflicting financial products, our inclusive approach is trusted by millions worldwide.

Yes. At nudge, we are committed to making impartial financial education accessible to all. Our platform complies with the Web Content Accessibility Guidelines (WCAG 2.1 AA) - the golden standard of web accessibility around the globe, to ensure that nudge can meet everyone's needs.

In partnership with the Royal National Institute of Blind People (RNIB), we have optimized the experience for neurodivergent people and those who require screen readers and keyboard accessibility. These improvements make our platform more inclusive for everyone.

Yes. There are two extra features that you can purchase to extend the reach and impact of your financial wellbeing program:

1. Friends and family premium

You can extend the gift of financial wellbeing to the loved ones of your people. Friends and family premium gives your people the opportunity to invite five people to set up their own personal nudge account - so they can also benefit from personalized financial education. Even better, those loved ones can be anywhere in the world and receive a nudge in the language that works for them, with education that is locally relevant.

Read how BnP Paribas improves the financial health of their friends and family

2. Alumni experience

Whether it’s voluntary resignation or due to business restructure (redundancy), it’s important to protect your brand as a caring, responsible employer once an employee leaves. Alumni experience allows you to continue providing nudge for an extra 6 months after a person leaves, so they can continue to benefit during this change in circumstance.

Get started for free today. Book a demo.

Networks and accreditations