Your global financial wellbeing program partner

nudge partners with the world’s leading organizations to design and deliver global financial wellbeing programs with our impartial, personalized financial education platform at the heart.

We work with you to create a global program with our impartial financial education platform at the heart. Importantly, your program is tailored to fit your available time and resources. And continuously refined using insights to drive greater impact on benefits uptake and employee financial health. Learn more about our approach here.

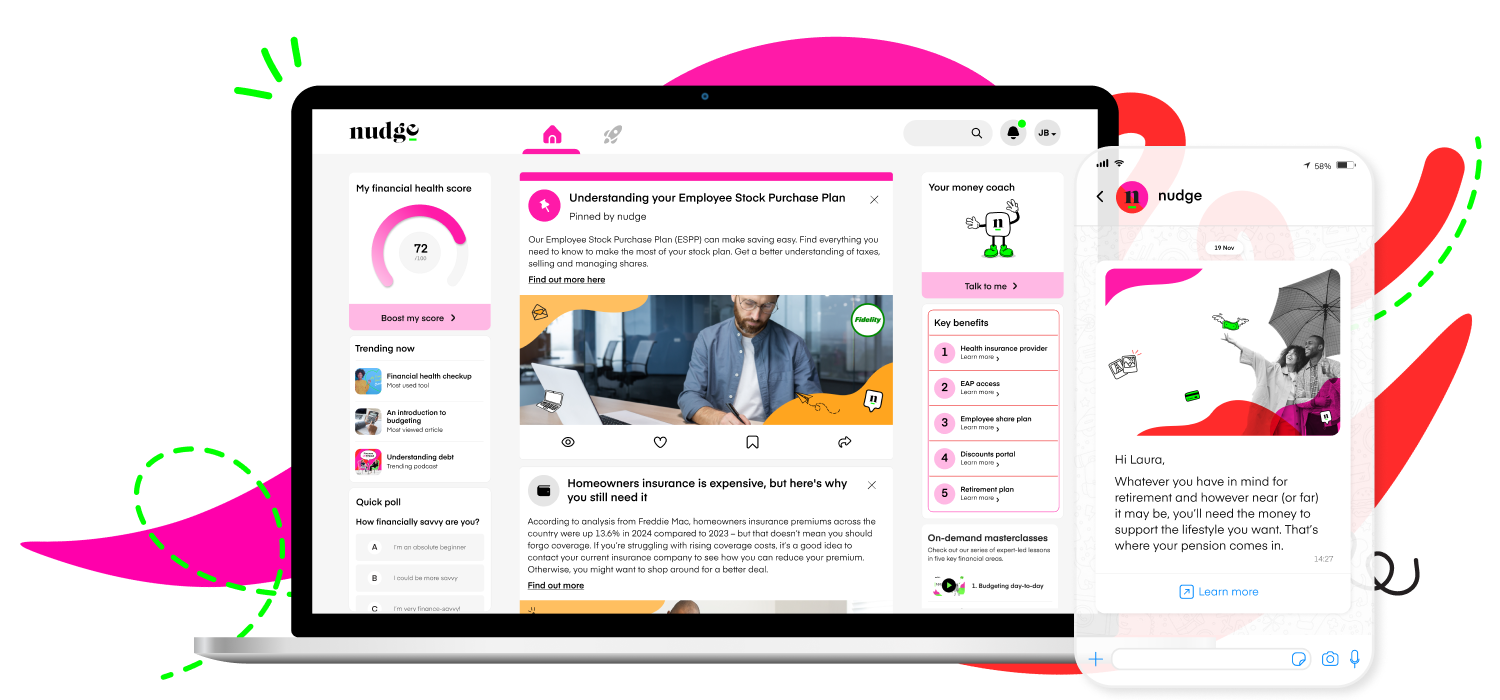

At the core of your global financial wellbeing program, nudge’s impartial financial education platform empowers your people to take control of their money. By combining AI, behavioral science, and localized financial expertise, we deliver personalized, timely financial and benefits education whenever and wherever it’s needed.

Explore platform

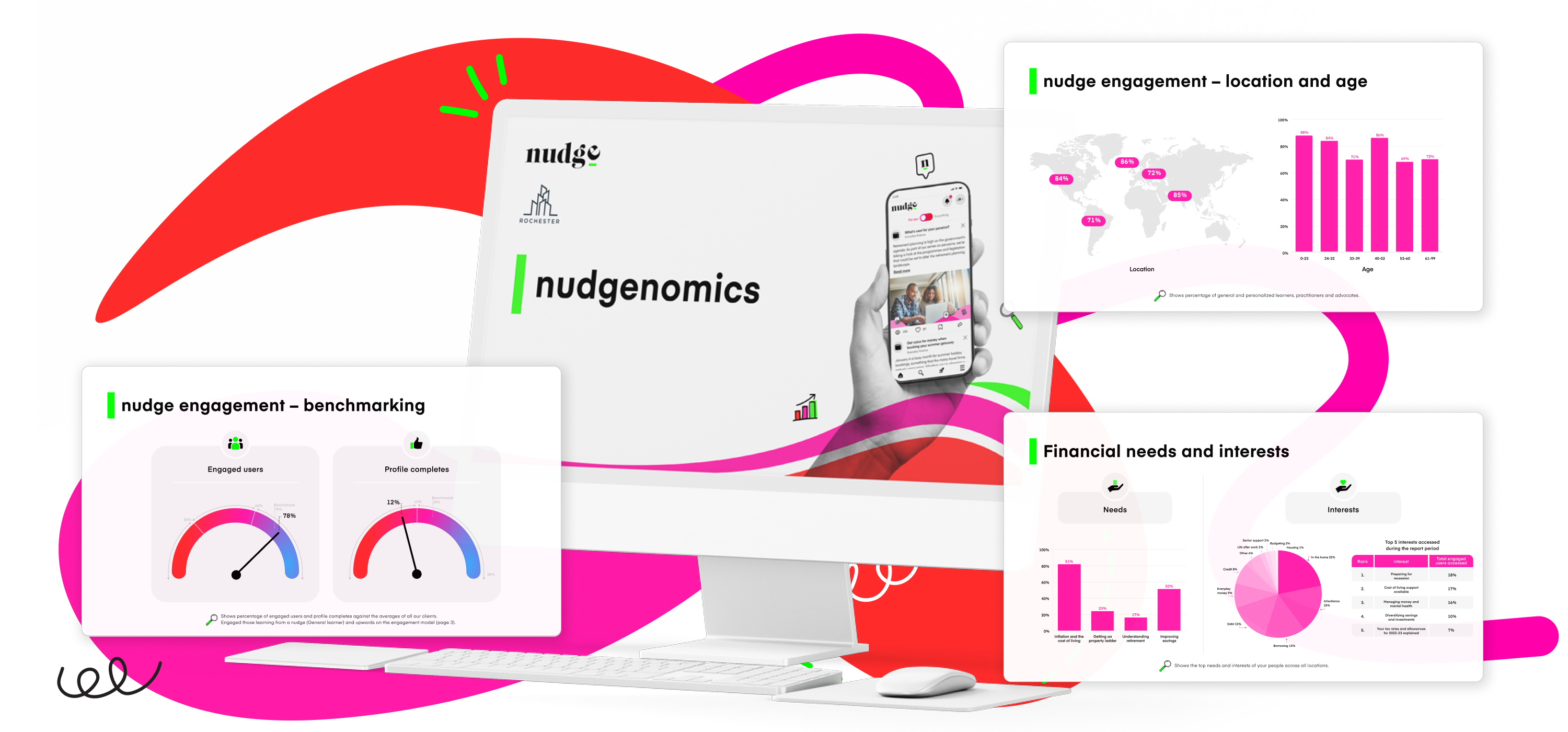

Access critical data and analytics that track engagement with nudge, employee financial health, benefit interactions, and more. Alongside demonstrating ROI, these insights will inform your reward and benefits strategy, delivering programs your people really want, and need.

Learn more

Your Total Rewards data embeds into our financial education journeys so the nuances of real-life financial decisions are explained within the context of the individual's salary, bonus, equity, retirement, and other benefits, driving better awareness, understanding, and uptake of what you offer.

Find out more

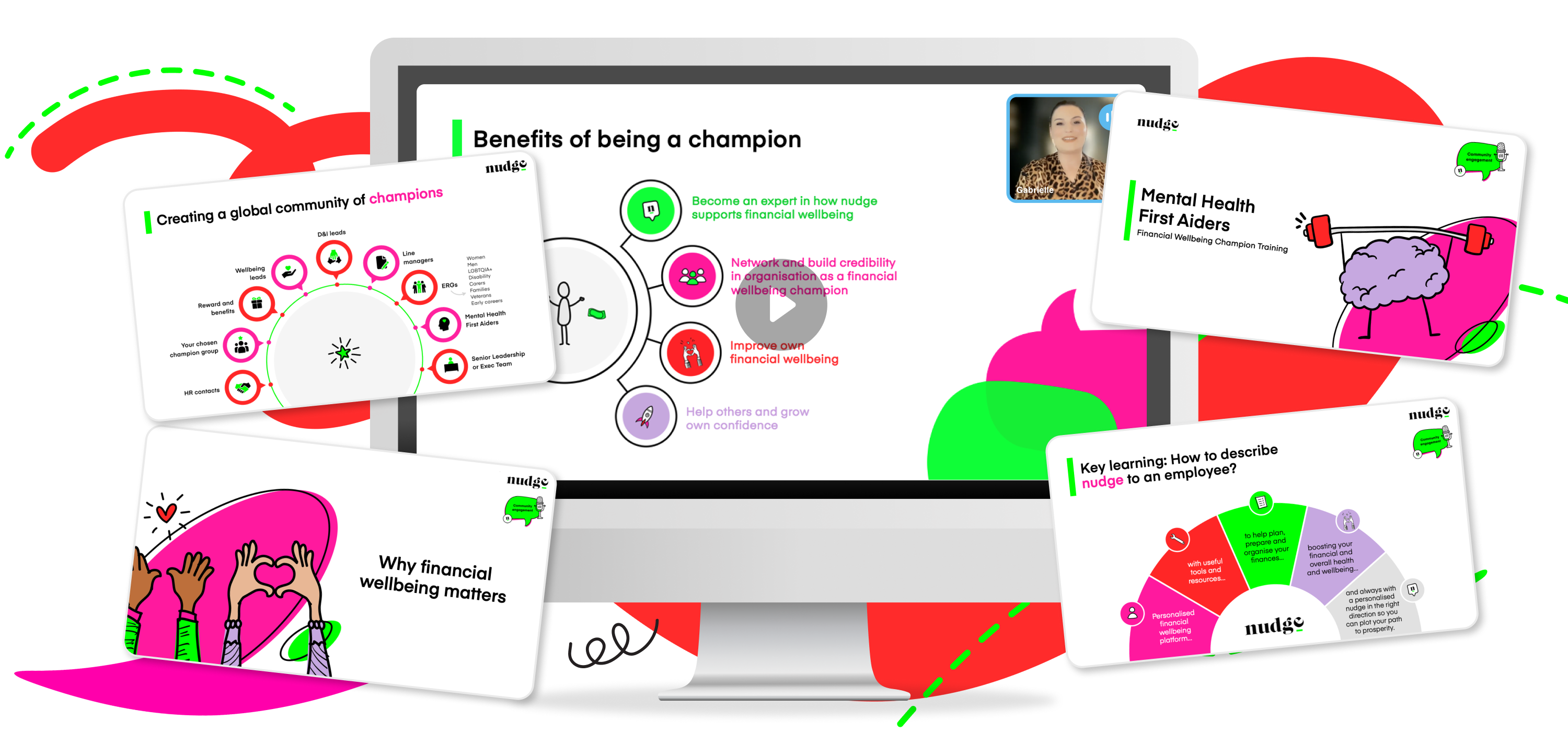

Delivered alongside the platform, live webinars unlock healthy money conversations and give your people the chance to learn in the moment, apply knowledge, and continue their financial wellbeing journey. We also offer advocate training and 'train the trainer' sessions to upskill stakeholders of your program to increase adoption.

Download brochure

We will work with you to create a comprehensive calendar of activity aligned to your organization's priorities and match benefits to promote with each moment. Our creative toolkits deliver timely awareness that sparks action.

Global financial wellbeing calendar

Beyond regular check-ins with your dedicated client success manager, our client-exclusive events give you access to the latest best practice and financial wellbeing developments–with a knowledge hub packed with resources and insights to help keep your program fresh.

Available in 160+ countries, nudge provides an impartial, safe space for people to navigate the volatile world of money.

Personalized experiences

An impartial, safe space for people to navigate the volatile world of money

Global mobility

Helping people relocate to a new financial environment

One global vendor

Offering simple reporting and management information

Local education

Relevant to everyone, everywhere

Identify the needs, wants and behaviors of your people to inform your program, benefits and HR initiatives.

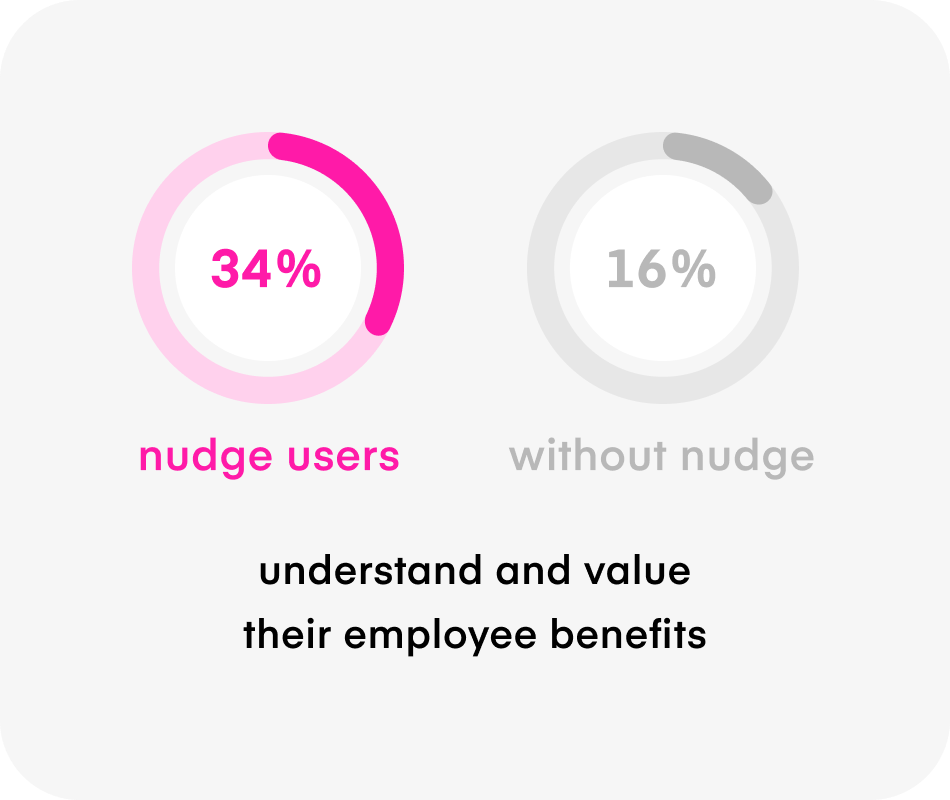

Timely, relevant education that drives awareness and uptake of your benefits, to support your employees and their loved ones.

Our experience is unparalleled in the market. We evidence impact on financial health and benefits uptake.

Get started for free today. Book a demo.

300+

Global clients

160+

Countries

2m+

Lives touched

Here are a few of our frequently asked questions. Looking for more? Check out the full list below. Or get in touch and we can talk.

Read full FAQsWe believe financial wellbeing is an outcome. It’s that feeling when you are in control of your money and prepared for your future.

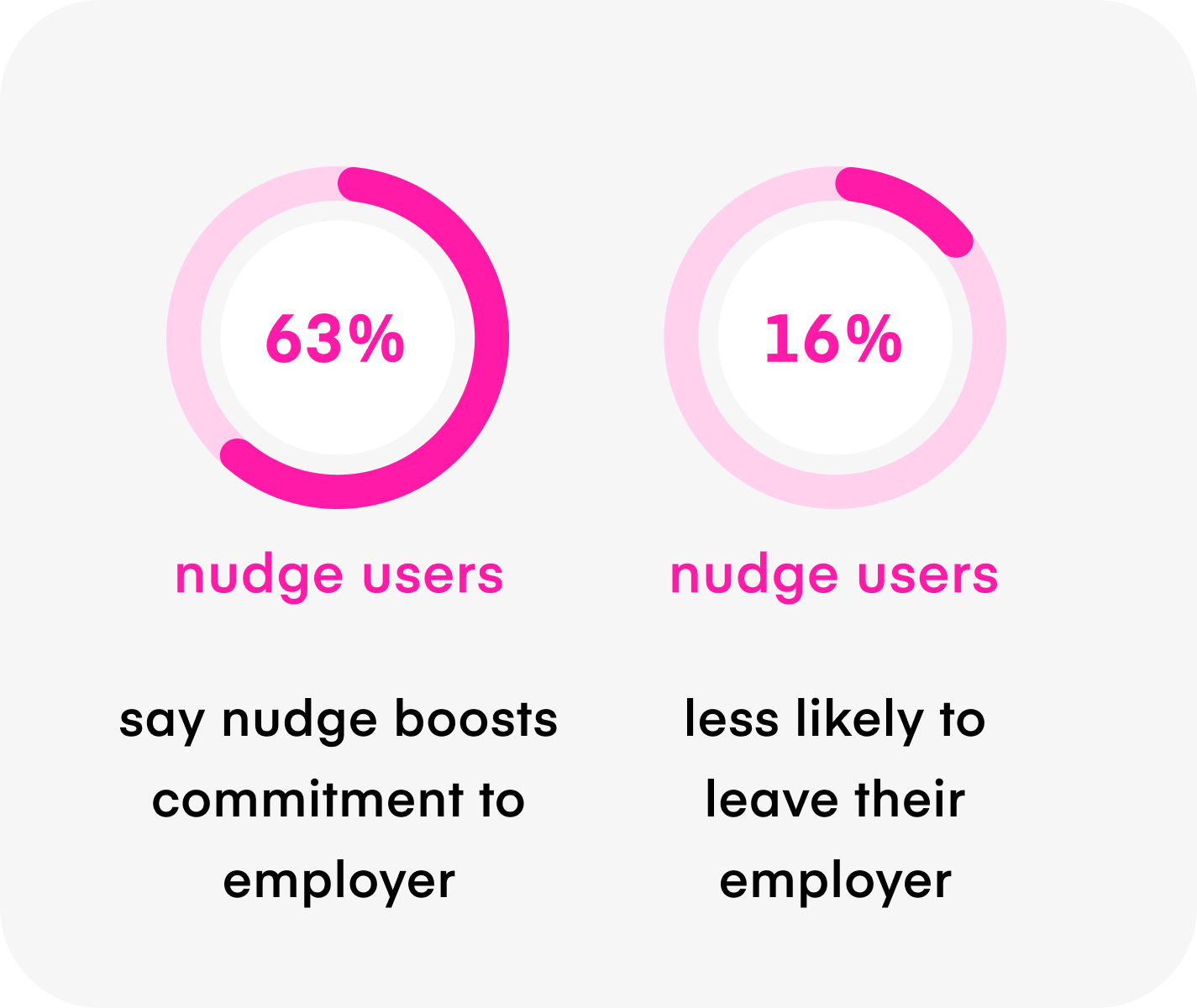

You can make maximum impact on an individual’s financial wellbeing by giving them the skills and knowledge to take action on their personal finance and employee benefits.

As a result, confidence builds so they can take control of their money and be more hopeful about their financial future.

Employers are in a unique position to provide the kind of financial education that can change lives. By incorporating financial education into their benefits program, organizations can ensure employees have the tools they need to thrive.

With nudge, you can expect:

Improve financial health

Increase take-up of benefits and wellbeing services

Wider business impact

We will work with you to align your financial wellbeing program with other business priorities for maximum impact, including:

Networks and accreditations