At the core of your global financial wellbeing program, nudge’s impartial financial education platform empowers your people to take control of their money.

have reduced their debt

have increased their savings

are more hopeful about their financial situation

By combining AI, behavioral science, and localized financial expertise, we deliver personalized, timely financial and benefits education whenever and wherever it’s needed.

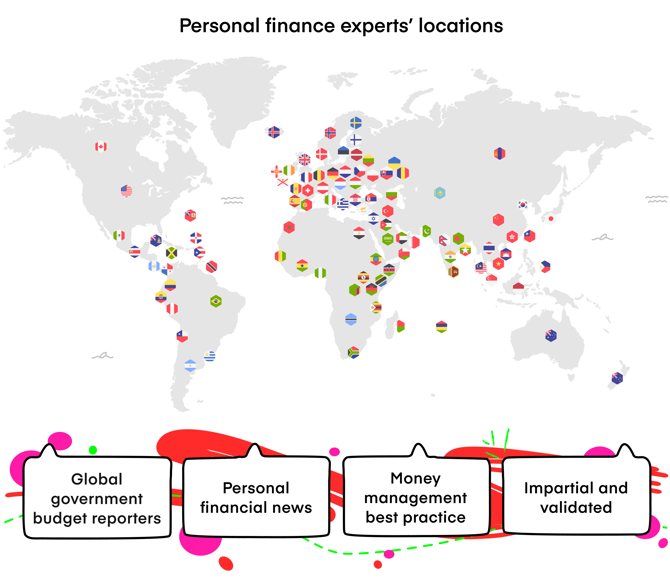

We offer a consistent, personalized technology experience with locally relevant education wherever you are in the world.

Our in-house team of locally accredited experts research, curate, design and publish our in-country financial and benefit education, giving you peace of mind that there is no outsourcing, and your people will not be given false, conflicting or misleading information.

All education sourced on the platform is validated by our team of experts. This includes integrations with only official sources, like government websites, so people can access trusted, up-to-date information, specific to their location.

Check out some recent examples of local education per region.

Please get in touch if you would like any additional examples.

nudge meets your people where they are, before they even know they need support. By analyzing employee behavior, financial health, and benefits engagement, the platform selects the right message from our expert-created, validated education — delivering it to the right person, at the right time.

When there’s something your people need to know, or a financial action they ought to take, we’ll send them a personalized, timely nudge as a reminder. They can choose to receive nudges via email, SMS, WhatsApp, and/or MS Teams.

Powered by AI, your people can ask their money coach a question and receive impartial, validated, and up-to-date information on their finances and benefits. This creates a safe space to understand the world of money and build skills.

Our financial health checkup enables your people to understand where they’re thriving and where there’s room for improvement. They get an instant score and a tailored financial education plan to help them improve their financial health.

Using profile data, market events, and employee added interests, your people consume education through an intuitive live feed. This personalization, along with multi-media formats, makes nudge a simple, natural, and engaging experience.

Money moments brings together the financial topics that shape everyday life. Whether planning goals, navigating challenges, or reacting to change, our intelligent tools and conversational prompts make money management effortless.

Imagine giving your people a way to connect with their personal finances anytime, anywhere, and in the language of their choice. nudge's money coach enables you to do just that.

Your people can ask their money coach a question and receive impartial, validated, and up-to-date education and information on their money and benefits – giving your people a safe space to navigate the world of money and take action.

Whether they're worrying in the middle of the night, or planning future goals with family, their personalized money coach is always there to support them with:

nudge brings together the financial topics that shape everyday life, tailored to your people’s personal goals, needs and challenges. Whether they’re planning ahead or reacting to change, our intelligent tools and conversational prompts make planning effortless.

Your Total Rewards data embeds into our hyper-personalized financial education journeys so the nuances of real-life financial decisions are explained within the context of the individual's salary, bonus, equity, retirement, and other benefits, helping your people to achieve their goals. Below are some of the tools available in money moments.

Help your employees to better understand your company-provided equity plan and what it means for them and in the country they’re in, including tax implications and planning tools for their personal situation.

Empowers people to explore how today’s choices shape future retirement outcomes, with clear, personalized projections and education on local lifetime allowances, tax rules, or contribution limits so they can make confident decisions about life after work,

Set your new starters up for success as part of their onboarding journey and give them a boost in their financial know-how within the context of your organization’s total rewards package.

Everything your people need to know when preparing for their relocation, all managed in one place – from setting up their finances, to understanding local taxes, social security, insurance, benefits, and more.

Your people can invite five people to set up their own private nudge account so they can also benefit from personalized financial education. They can be anywhere in the world and access nudge in the language that works for them, with education that is locally relevant.

It’s important to protect your brand as a caring, responsible employer once an employee has left due to redundancy. You can provide nudge for an extra six months after a person leaves, so they can continue to benefit during this change in circumstances.

With our community engagement offering, employees join sessions with experts directly on the nudge platform, where they can engage with education in real time and continue taking action on their finances immediately, without ever switching platforms.

There’s no need for extra logins, app-switching, or context lost between tools. It’s one connected experience that empowers people to learn and act with confidence. Below you’ll find a quick overview of the options:

Watch these bite-size user stories and explore how people around the world are building their knowledge, skills, and confidence to improve their financial health.

Ready to see it in action? Book a demo.

Here are a few of our frequently asked questions. Looking for more? Check out the full list below. Or get in touch and we can talk.

READ FULL FAQSnudge provides a seamless end-to-end integration with your existing HR tech, benefit providers, and communication channels, including SAP SuccessFactors, Oracle and Workday.

Our platform connects to all major HRIS and benefit providers to manage the data transfer via API. We enable the easy use of Single Sign-On (SSO) by supporting any SAML2 and other SSO configurations.

In addition, we connect with popular internal communication channels, including WhatsApp, email, SMS, and MS Teams.

Our simple plug and play solution means that your employees experience frictionless, secure, and simple access to nudge whenever, wherever they need it.

Yes. At nudge, we are committed to making impartial financial education accessible to all. Our platform complies with the Web Content Accessibility Guidelines (WCAG 2.2 AA) - the golden standard of web accessibility around the globe, to ensure that nudge can meet everyone's needs.

In partnership with the Royal National Institute of Blind People (RNIB), we have optimized the experience for neurodivergent people and those who require screen readers and keyboard accessibility. These improvements make our platform more inclusive for everyone.

Every organization is unique. That’s why we work with you to understand the goals of your program. Using data insights from 2 million global nudge community, we create a best practice global program tailored to your requirements.

With our impartial, global financial education platform at the heart, we work you to design and deliver a financial wellbeing program that includes benefits education, internal communication campaign toolkits, and live masterclasses.

Importantly, your program is tailored to fit your available time and resources. And continuously refined using insights to drive greater impact on better decision making, benefits uptake and employee financial health.

Networks and accreditations