Prove the ROI of nudge, and your financial wellness program, through data. Inform decisions to increase uptake of benefits and demonstrate wider business outcomes.

Every interaction with nudge offers insight, helping you to identify what truly matters to your people and optimize the support you provide.

Our powerful people analytics dashboard, nudgenomics, gives you clear insight into your peoples' wants, needs, dreams, and goals – helping you to make smarter decisions to enhance employee experience and organizational performance.

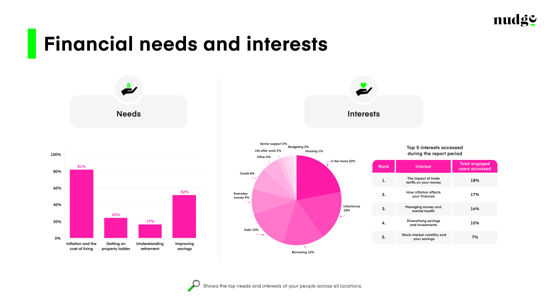

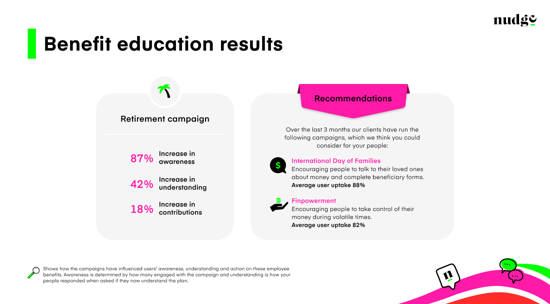

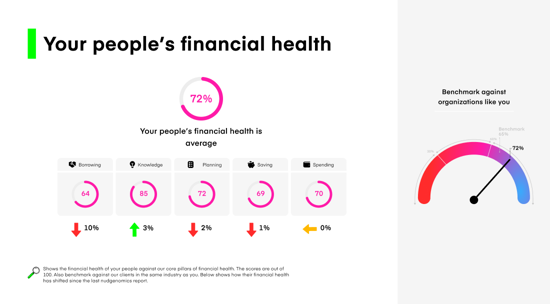

Data is presented in a clear, easy-to-digest format, giving you insight on your people’s engagement with nudge, overall financial health, needs, and interests, benefit campaign engagement, and wider business impacts (see examples below).

Your Client Success Manager works with you to understand current trends and benchmarks, helping you to identify key areas for action, and shape strategic benefit decisions. These insights are then built into your financial wellbeing program and calendar. Find out more about the type of data you will get access to in our nudgenomics factsheet.

“The ongoing partnership with nudge is great. They work with us to make it a success and the nudgenomics reporting is especially useful in creating targeted actions.”

Artur Jager, Director Executive Compensation, GlaxoSmithKline

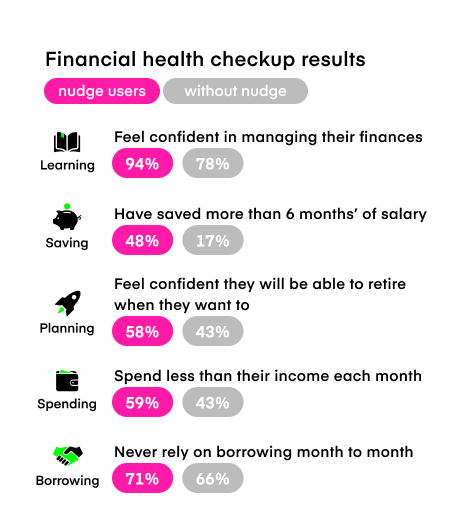

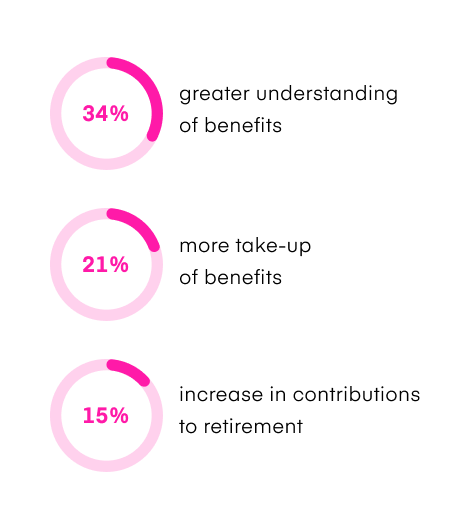

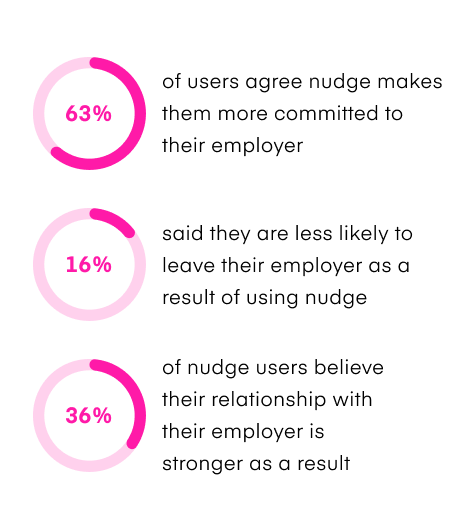

Using comprehensive mixed-method qualitative and quantitative research, impartial research partner Censuswide analyzed and compared nudge users with non-nudge users. The findings revealed:

Here are a few of our frequently asked questions. Looking for more? Check out the full list below. Or get in touch and we can talk.

Read full FAQsWe believe financial wellbeing is an outcome. It’s that feeling when you are in control of your money and prepared for your future.

You can make maximum impact on an individual’s financial wellbeing by giving them the skills and knowledge to take action on their personal finances and employee benefits.

As a result, confidence builds so they can take control of their money and be more hopeful about their financial future.

Employers are in a unique position to provide the kind of financial education that can change lives. By incorporating financial education into their benefits program, organizations can ensure employees have the tools they need to thrive.

With nudge, you can expect:

The nudge platform combines personal finance education, data and behavioral psychology to provide individuals with in-the-moment, personalized financial education. nudge provides peace of mind that when something happens in the world of money that you need to know about, you have access to a safe-space to learn about it and take action.

Get started for free today. Book a demo.

Networks and accreditations