Improve employee financial wellness and drive uptake of employee benefits through financial education and personalized, timely communications.

of nudge users are more confident in managing their finances

of nudge users have a greater understanding of their benefits

300+ organizations across the world trust nudge

Chat to our team to understand how financial wellbeing can support your corporate employee wellness programs.

The nudge technology seamlessly integrates with popular benefit providers to drive awareness, understanding and uptake of all your benefits, from health insurance to retirement plans, wellness programs and much more. On nudge, you can segment and promote the right benefits to the right person, at the right time through trigger-based communications.

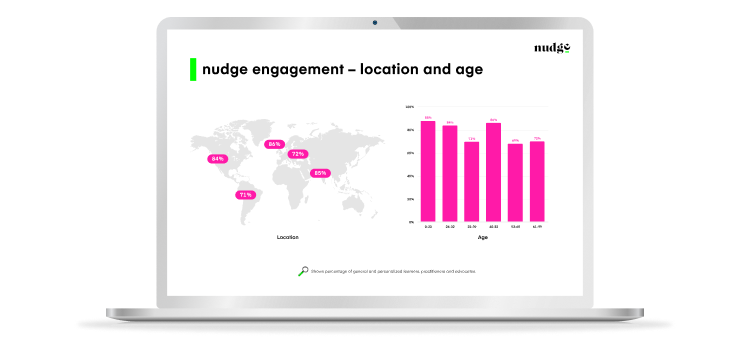

Access to critical data with nudgenomics (nudge’s analytics). Track engagement with nudge, employee financial health, needs and interests, benefit campaign engagement, and wider business impact. As well as enabling us to increase the impact of nudge, these insights will inform your wellness and employee benefit strategy, delivering programs your people really want, and need.

Learn more

Our financial wellbeing calendar is created from over ten years of experience and insight into when financial wellbeing is needed the most throughout the year. Beyond a comprehensive launch plan, our calendar campaign toolkits are out-of-the box communications for your internal channels. Critical to driving awareness and engagement with nudge and your wider benefits, these campaigns motivate regular platform engagement throughout the year with improved outcomes.

Most companies have employee resource groups e.g. women’s or pride networks that are perfect to spread the good word about the benefits you offer. Our financial wellbeing champion training empowers groups to improve their financial wellbeing and signpost others to nudge to take action on theirs.

Download brochureHere are a few of our frequently asked questions. Looking for more? Check out the full list below. Or get in touch and we can talk.

Read more FAQsnudge is an impartial, global financial education platform for all. Combining behavioural psychology, data and personalized education, nudge empowers people to develop their financial skills and knowledge. A global solution without conflicting financial products, our inclusive approach is trusted by millions worldwide.

We live in an increasingly chaotic world where information and advice on money can be overwhelming, conflicting, and in some cases, downright dangerous.

nudge simplifies the complex and helps address the common challenges many of us have when it comes to money:

No time? Prompts and reminders

When there’s an event in personal finance an individual needs to know about, or take action on, nudge will send a personalized, timely, prompt or ‘nudge’ to let them know.

Don’t know where to start? Personalized guidance

nudge gives individuals financial skills and knowledge, designed just for them. Right from their first visit, there’s always a clear next step in their financial wellbeing journey.

Not in control? Money management tools

Our selection of interactive tools help individuals plan, prepare and organize their finances. From budgeting and managing debt, to modelling out savings or investments, our tools are easy-to-use and built around the individual.

Employers are in a unique position to provide the kind of financial education that can change lives. By incorporating financial education into their benefits program, organizations can ensure employees have the tools they need to thrive.

With nudge, you can expect:

300+

global clients

100+

countries

1.5m+

lives touched