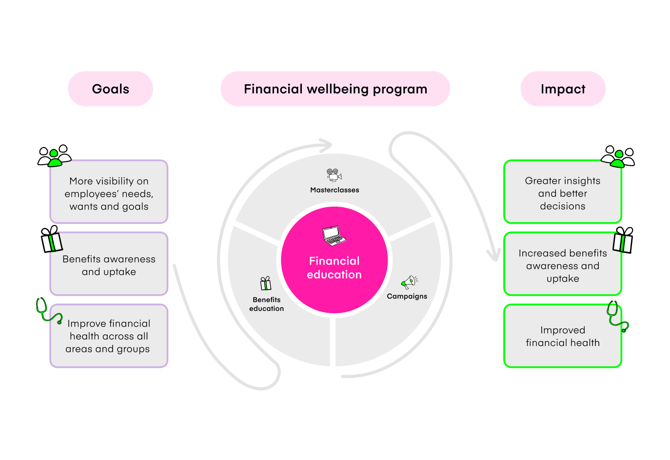

nudge partners with you to design and deliver your global financial wellbeing program, with our impartial financial education at the heart.

Identify the needs, wants and behaviors of your people to inform your program, benefits and HR initiatives.

Timely, relevant education that drives awareness and uptake of your benefits, to support your employees and their loved ones.

Our experience is unparalleled in the market. We evidence impact on financial health and benefits uptake.

Every organization is unique. That’s why we work with you to understand the goals of your program. Using data insights from the nudge community of 2 million people worldwide, we create a best practice global program tailored to your requirements.

With our impartial, global financial education platform at the heart, we deliver your program that includes benefits education, internal communication campaign toolkits, and live masterclasses. You can find out more about these offerings below.

Importantly, your program is tailored to fit your available time and resources. And continuously refined using insights to drive greater impact on better decision making, benefits uptake and employee financial health.

Access to critical data with nudgenomics (nudge’s analytics). Track engagement with nudge, employee financial health, needs and interests, benefit campaign engagement, and wider business impact. As well as enabling us to increase the impact of nudge, these insights will inform your wellness and employee benefit strategy, delivering programs your people really want, and need.

Learn more

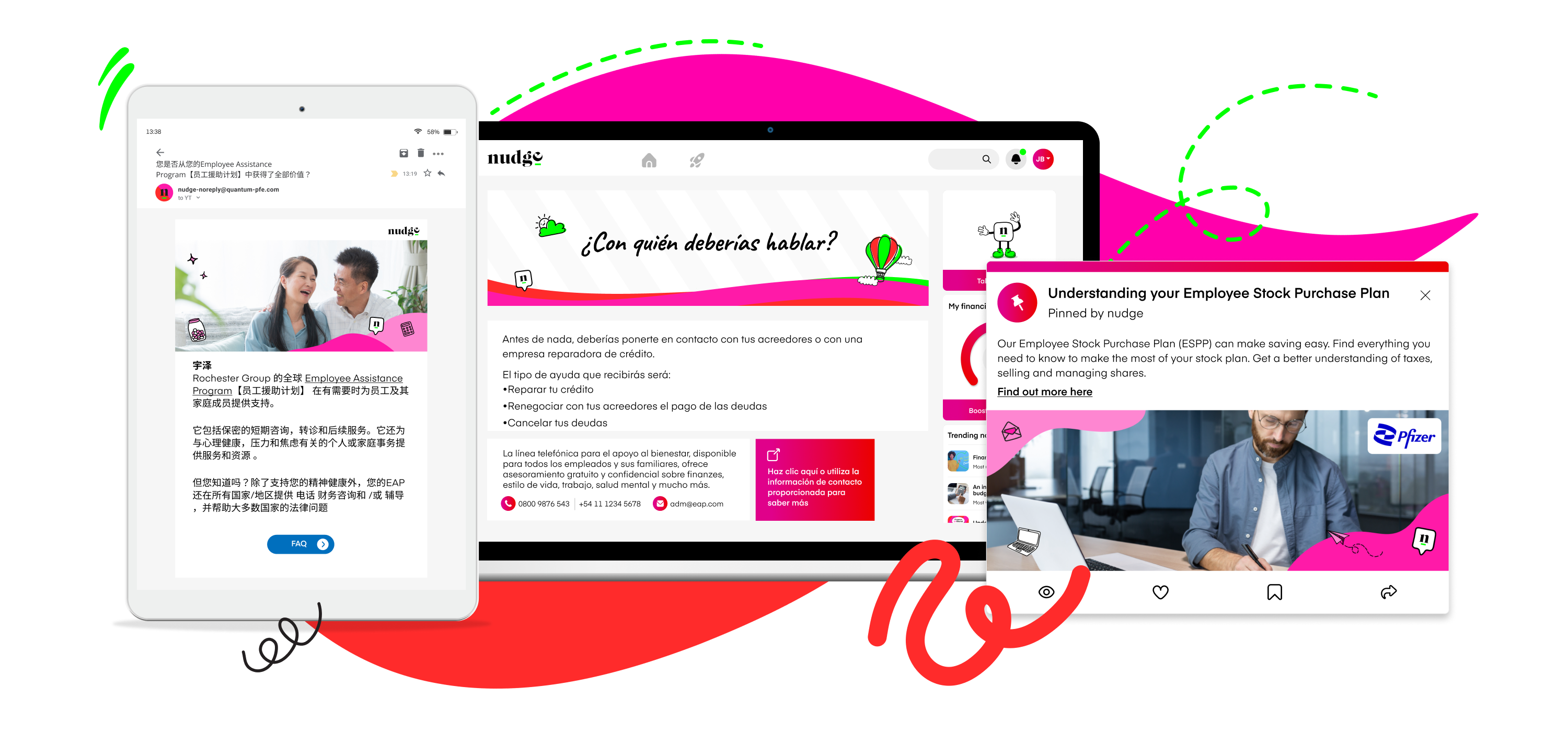

The nudge technology seamlessly integrates with popular benefit providers to drive awareness, understanding and uptake of all your benefits, from health insurance to retirement plans, wellness programs and much more. On nudge, you can segment and promote the right benefits to the right person, at the right time through trigger-based communications.

Live, interactive webinars unlock healthy conversations about money. There are three types of masterclasses that maximize your investment in nudge: Introduction to nudge (to get your people engaged in the platform), Financial wellbeing champion training (to upskill key stakeholders on your program to increase adoption) and community masterclass (for your ERGs to improve their financial wellbeing).

Download brochure

We will work with you to create a calendar packed full of key social awareness events and wider initiatives in your organization. Against these dates, we map out the benefits that align so we can provide timely benefits education and encourage action. Throughout the year, our creative communication toolkits support the milestones in your financial wellbeing program to drive activity.

2025 Global financial wellbeing calendar

Beyond regular business reviews with your dedicated client success manager, our client-exclusive events give you access to the latest best practice and financial wellbeing developments. As well as a client community hub packed with resources and insights to keep your program fresh.

nudge provides an impartial, safe space for people to navigate the volatile world of money

Something for everyone

Topics and mixed media education

Data driven personalization

Right education, to the right person, at right time

WCAG compliant

Highest accessibility standard

Community support

Targeted campaigns and masterclasses for employee resource groups

Global tech experience

Equitable support for all your locations

Learn how Expedia rolled out nudge in 57 countries.

Read client story

300+

Global clients

100+

Countries

2m

Lives touched

Here are a few of our frequently asked questions. Looking for more? Check out the full list below. Or get in touch and we can talk.

Read more FAQsnudge is an impartial, global financial education platform for all. Combining behavioural psychology, data and personalized education, nudge empowers people to develop their financial skills and knowledge. A global solution without conflicting financial products, our inclusive approach is trusted by millions worldwide.

All the education on the nudge platform is created by our in-house team of international personal finance experts. This way we can ensure that the education we provide is high quality, consistent and 100% impartial – reducing the risk of misinformation.

You’ll need to set up the transfer of data at an agreed frequency via SFTP so we know who to provide with access to nudge. From an individual experience perspective, we can provide nudge as:

Get started for free today. Book a demo.

Networks and accreditations