Driving uptake of your global benefits

The world of money and employee benefits can be filled with jargon. We’re here to simplify this and educate your employees on their finances and benefits, no matter their background or financial literacy level.

greater understanding of employee benefits

increase in benefits take-up

increase in retirement contributions

Employers invest significantly in employee benefits. However, most employees don't have a strong understanding of their benefits or how to make the most of them—undermining both employee wellbeing and the effectiveness of benefit strategies.

Regardless of the benefit, our technology seamlessly integrates your benefits to drive better awareness, understanding, and uptake of what you offer.

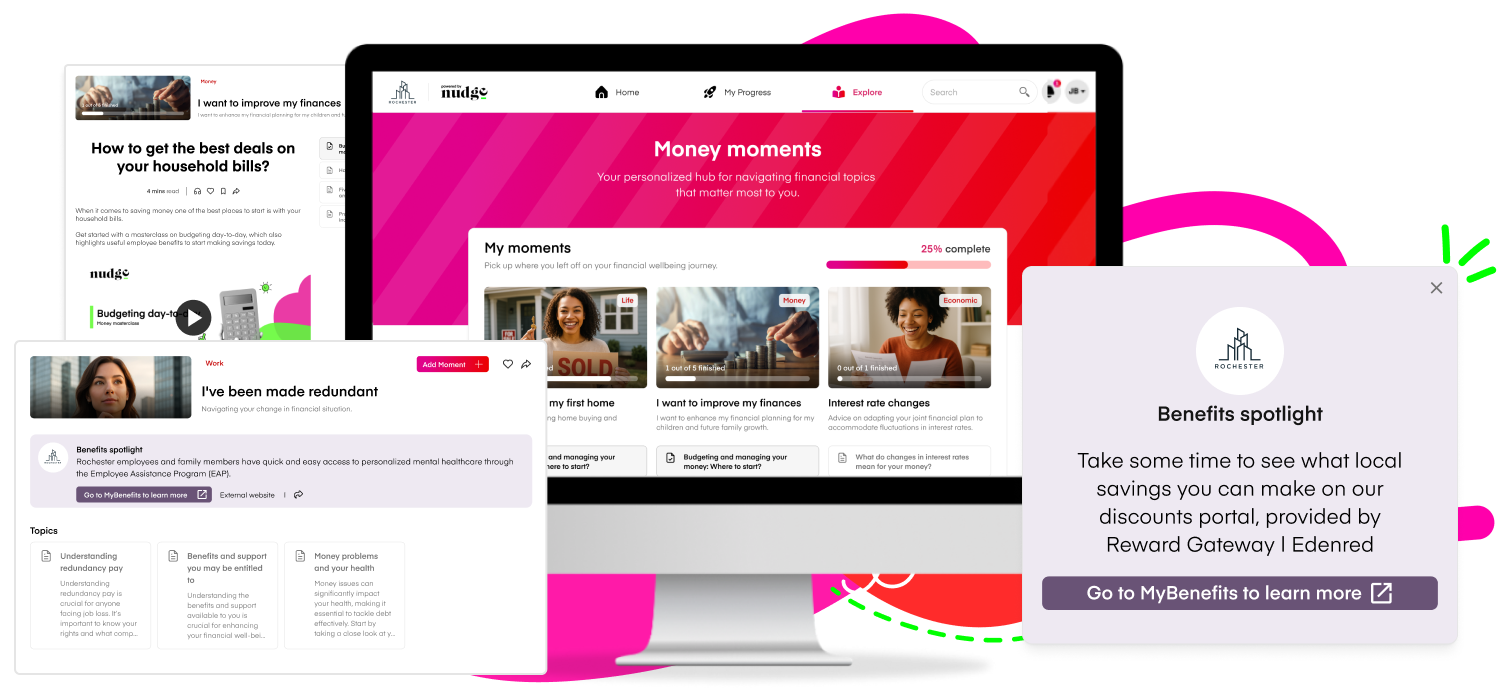

Your Total Rewards data embeds into our hyper-personalized financial education journeys, so the nuances of real-life financial decisions are explained within the context of the individual's salary, bonus, equity, retirement, and other benefits, helping your people to achieve their goals.

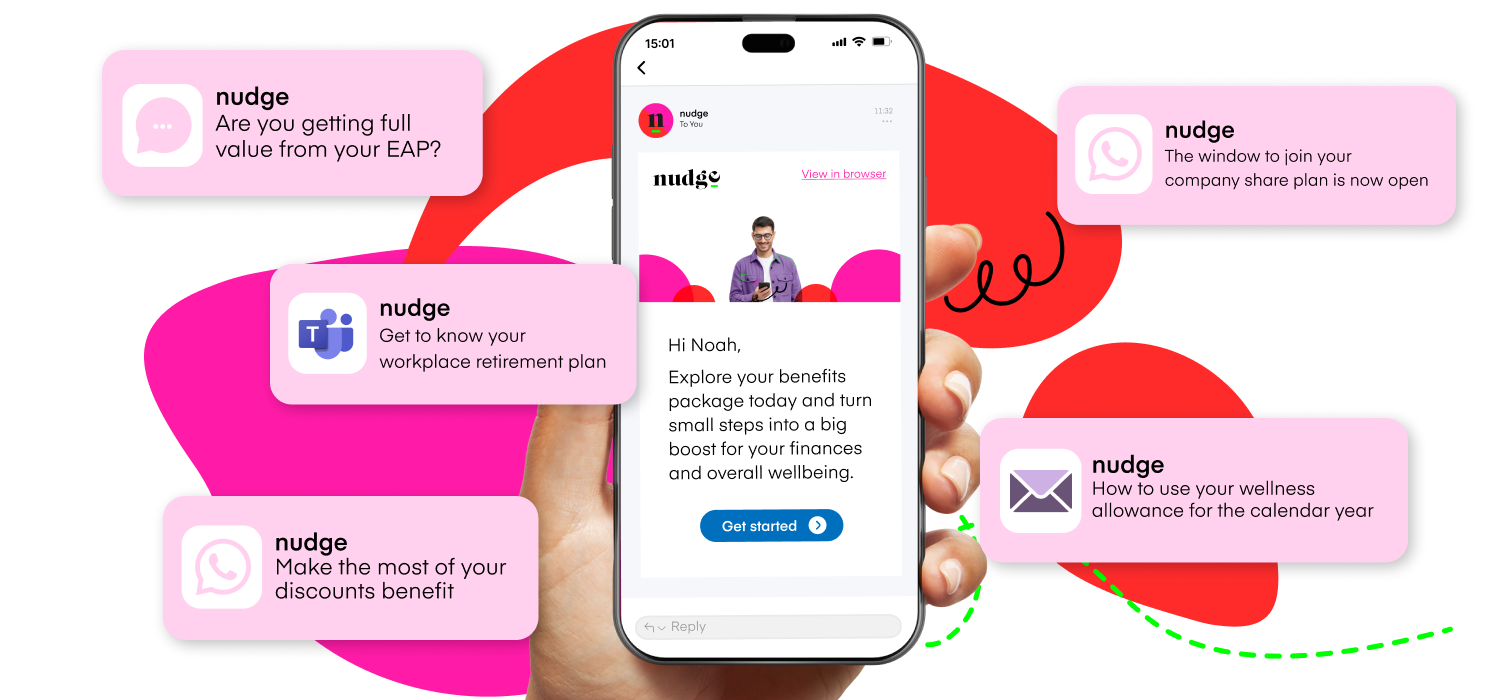

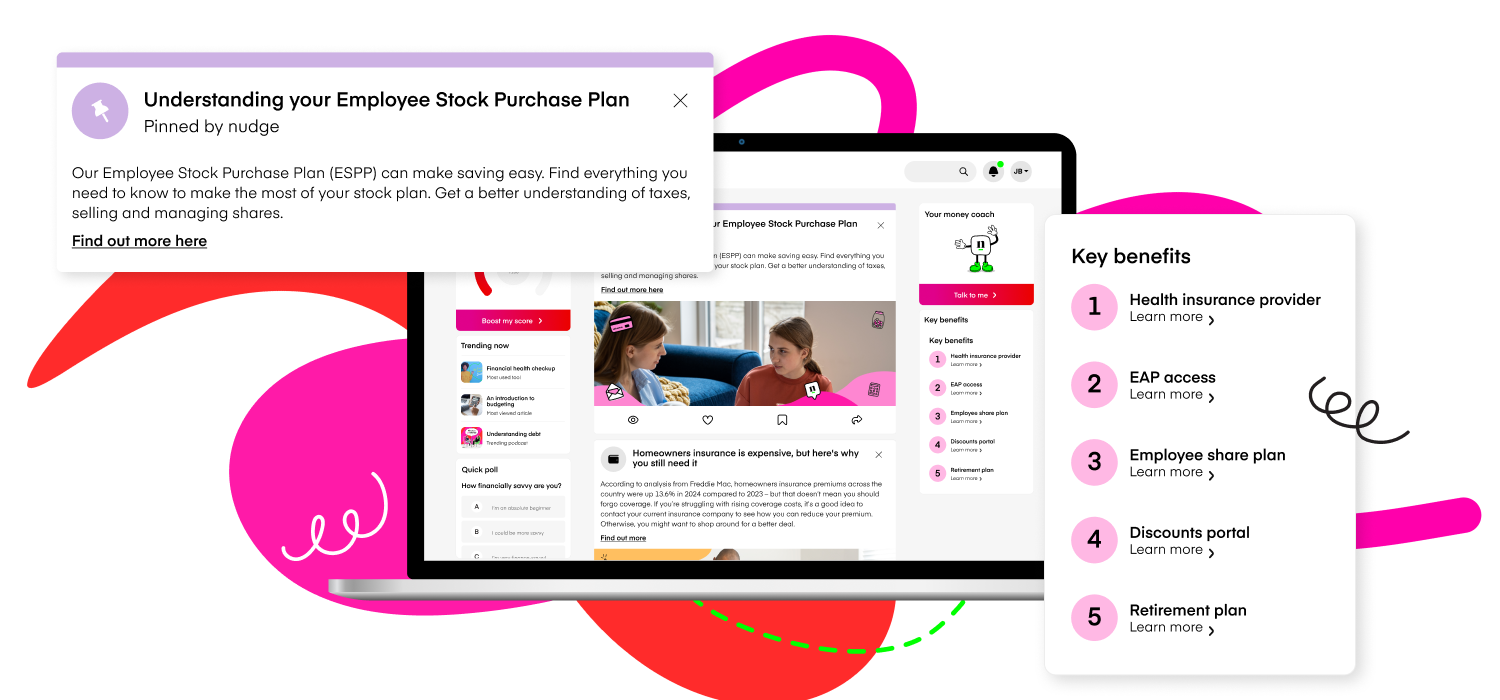

We nudge the right person at the right time for the right reasons. With multiple employee benefits in your offering, our personalized nudges communicate your program or focus on relevant employee benefits for the individual so they are aware of what is on offer and take action. They can choose to receive nudges via SMS, WhatsApp, email, and/or MS Teams.

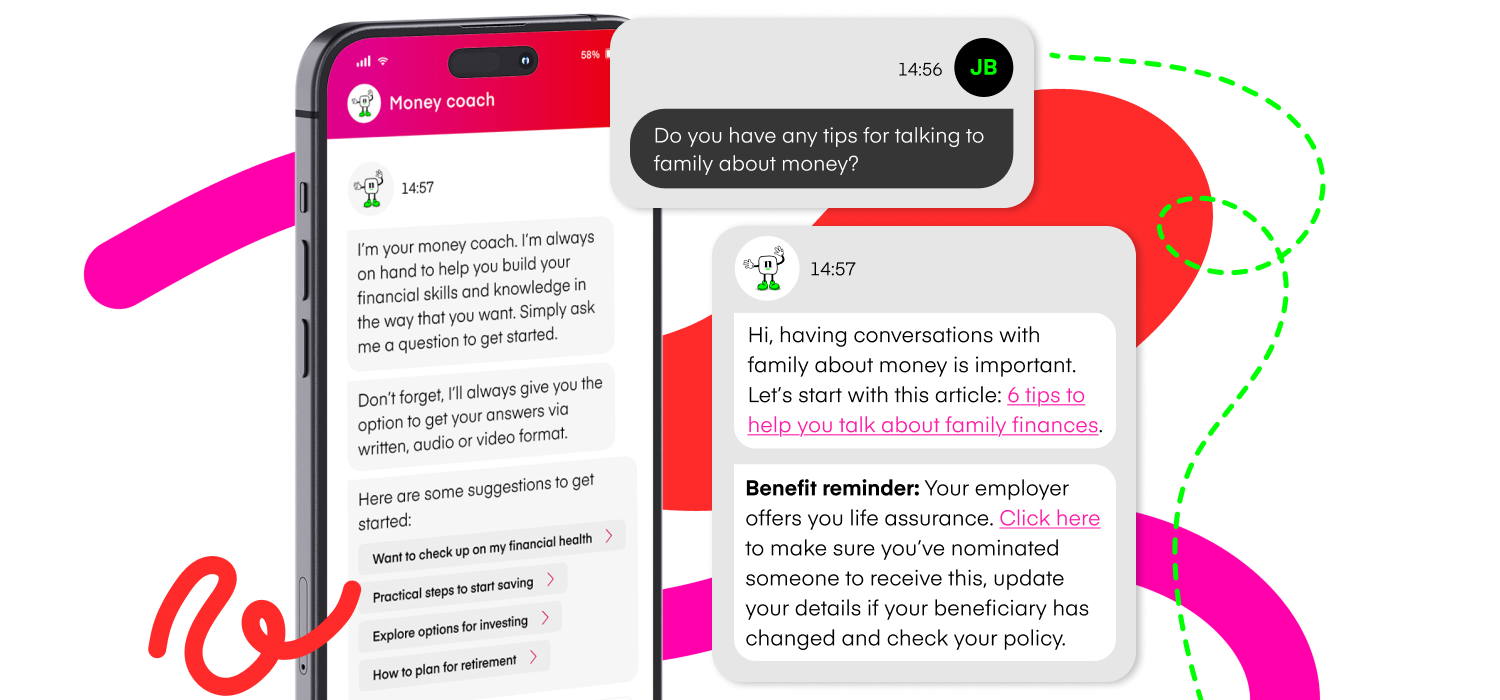

Powered by AI, your people can ask their money coach a question and receive impartial, validated, and up-to-date education. Essential to drive benefits uptake, the money coach integrates all company benefits information. Within the context of the employee’s question and responses, the money coach can source relevant benefits in their answers to increase visibility and adoption.

Spotlight the benefits you want to promote on the nudge platform homepage. Pinned posts at the top of your people’s live feed and benefits panel on the side of the page can link out to key benefits. As the first place your people go to when they log on to nudge, this maximizes the opportunity for your people to learn about the benefits you want to increase engagement with.

We incorporate your benefits within the financial education on nudge, including our live masterclasses. As your people learn about a particular topic, they can also understand what is available to them. For example, if someone is engaging with education on debt management, we can signpost them to their EAP as a resource to utilize if needed.

We will work with you to create a financial wellbeing calendar packed with events, initiatives and campaigns. Against these dates, we plot out benefits that you want to educate your people on. For example, encouraging people to update their beneficiary forms to protect their family’s finances on International Day of Families. Campaign toolkits drive action through nudge and your internal communication channels.

Ready for a demo? Get in touch today.

The missing link between benefits awareness and utilization

How to boost benefits utilization with impartial, personalized financial education

Global benefit edu-action:

It's time to make moves on your benefits

Here are a few of our frequently asked questions. Looking for more? Check out the full list below. Or get in touch and we can talk.

READ FULL FAQSThe nudge platform combines AI, behavioral science, and localized financial expertise to deliver personalized, timely financial and benefits education whenever and wherever it’s needed. nudge provides peace of mind that when something happens in the world of money that you need to know about, you have access to a safe-space to learn about it and take action.

The nudge platform helps you to better understand your finances, take action and plan your future. Key features include:

Our powerful data analytics dashboard called ‘nudgenomics’, provides a wealth of insight into how individuals are engaging with nudge, all presented in a digestible format. A high-level overview of your nudgenomics data, presented in one dashboard.

Our financial health checkup also monitors improvements in financial health, giving you the data to show tangible wellbeing impact.

You can use this data to inform your wellbeing and employee benefit strategy, with benefits your people really need to achieve their goals. With this information you can use nudge as an education tool, targeted to an individual's needs, and maximize your reward spend by driving a better understanding of your employee benefits.